We explore under different exchange rate regimes how fiscal rules and institutions can reduce the procyclical stance of fiscal policy (i.e. how government spending responds to GDP fluctuations). We construct a fiscal rules index which is a composite index measuring the overall strength of fiscal rules in a country at a given time. We use it in a dynamic model with a GMM estimator, for a panel of 153 countries over the period 1993–2015. We find that under fixed exchange rate regimes, while better institutions can reduce procyclicality, rules increase it or do not affect it. This result suggests that under fixed exchange rate regimes, a focus should be put on stronger institutional quality rather than on the adoption of fiscal rules. However, under flexible exchange rate regimes, we find that institutions and rules are complementary in reducing procyclicality. Rules help reduce procyclicality and are more effective, in particular, when institutions are stronger. Our results are robust to different specifications as well as to the use of alternative variables of institutional quality.

Avoid common mistakes on your manuscript.

A decade ago, the Global Financial Crisis (GFC) and governments’ attempts to face it have eroded fiscal positions in many countries. The budgetary difficulties raised concerns about the sustainability of public finances and underlined the importance of adopting appropriate measures in order to put public finances on a sustainable path. The critical issue of sovereign debt solvency faced by many advanced economies in the aftermath of the crisis, including some European Union members, has all the more depicted the importance of budgetary discipline. In fact, in the context of sovereign debt crisis, countries had their credit ratings reduced by rating agencies and were in some cases forced to curtail fiscal expansion.

The question of how countries can pursue macroeconomic stabilization policies while maintaining the growth of public debt on a sustainable path in the long run was of great interest among policy makers and, more importantly, has currently been put at the forefront of the policy debate, currently with the Covid-19 crisis. A mechanical solution to ensure debt sustainability is that countries pursue fiscal stimulus measures during a downturn (bust) in the economic cycle followed by fiscal contraction and debt reduction in a period of recovery of the economic activity (boom). In other words, countries are encouraged to pursue a counter-cyclical fiscal policy. Fiscal policy is considered procyclical when governments choose to increase public spending and reduce taxes during an economic boom, or to reduce spending and increase taxes during an economic recession. Such procyclical policy cannot be optimal since it will tend to reinforce the business cycle, exacerbating booms and aggravating busts. The circumstances in which countries tend to perform procyclical fiscal policy include: (1) imperfect access to international credit markets and lack of financial depth (Caballero and Krishnamurthy 2004; Gavin and Perotti 1997; Gavin et al. 1996; Riascos and Vegh 2003; (2) political distortions (Talvi and Vegh 2005; Tornell and Lane 1999; Velasco 2008). The lack of access to credit markets in bad times naturally leaves governments with no choice but to cut spending and raise taxes, whereas political pressures for additional spending in good times are hard to resist. Improving access to credit in bad times (including official financial assistance from international institutions such as the IMF) and designing rules and institutions that aim at ensuring that fiscal revenues are saved in good times so that they are available in bad times would go a long way to alleviate the scourge of procyclical fiscal policy. Overcoming the problem of procyclicality by saving fiscal revenues in good times so that they are available in bad times—hereby performing countercyclical fiscal policy—is recognized to be an optimal policy for debt management and for macroeconomic stability. For example Christiano et al. (2011) and Nakata (2011) find theoretical evidence of the convenience and usefulness of countercyclical policy.

However, in general, empirical evidence shows that fiscal policy can have both a procyclical and a countercyclical stance (Gavin and Perotti 1997; Tornell and Lane 1999; Alesina and Tabellini 2005; Talvi and Vegh 2005; Thornton 2008; Diallo 2009; Frankel et al. 2013; Bova et al. 2014; Ianc and Turcu (2020). For example, Gavin and Perotti (1997) show that fiscal policy is procyclical in Latin American countries. Kaminsky et al. (2004) or Alesina and Tabellini (2005) find that, in general, fiscal policy tend to be more procyclical in developing countries than in advanced countries. Different factors (e.g. development level, public debt, quality of institutions, policy responses, exchange rates) are put forward in the aforementioned studies to explain the cyclicality of fiscal policy.

The debate on the role of fiscal policy for macroeconomic stabilization is currently on top of priorities due to the Covid-19 shock which has caused the current economic downturn characterised by low growth and high unemployment around the world. Many countries have to pursue stabilization policies mostly using fiscal expansion. However, the lack of fiscal space and hence less favorable fiscal positions make it hard to overcome the side effects of the crisis on the real economy and indeed increase the risk of unsustainable debt levels. Countercyclical tools are essential in this setting, for macroeconomic stabilization: the recent global crises (the global financial crisis and the Covid-19 crisis) have all the more depicted their importance.

A large body of the literature analyzing the cyclicality of fiscal policy insists on its relationship with exchange rate regimes. One question that emerges in this framework is whether fixed regimes or flexible ones promote countercyclical fiscal policy and more generally fiscal discipline.

To govern the conduct of fiscal policy, budgetary authorities have focused their attention on fiscal rules and institutions, especially following the global financial crisis and in the context of the European sovereign debt crisis (Bergman et al. 2016). Fiscal rules are agreements designed to mitigate the deficit bias and promote fiscal discipline by constraining budgetary aggregates. The popularity of budgetary rules has increased in recent years: at this time, 89 countries have adopted national and supra-national rules to govern their fiscal policy, compared to 10 in the 1990s. This can be explained by several factors (Bova et al. 2014): (1) adoption of fiscal rules in particular by the members of currency unions in order to facilitate fiscal policy convergence within the union; besides, emerging, transition and developing countries have also chosen to implement fiscal rules (2) consolidation of the liberalization programs and reforms and/or (iii) reactions to increasing public debt. Nevertheless, relatively little work has been undertaken on the functioning and effectiveness of these rules. Moreover, good and efficient institutions might be helpful in promoting sustainable public finance (Bergman and Hutchison 2015; Bergman et al. 2016; Talvi and Vegh 2005). Hence, this could be an interesting issue to be analyzed jointly with the fiscal rules.

Within this framework, our paper tries to fill a gap by examining how fiscal rules and institutions affect fiscal policy procyclicality. More interestingly, we analyse under alternative types of exchange rate regimes whether institutions and fiscal rules are substitutes or complements in reducing fiscal policy procyclicality.

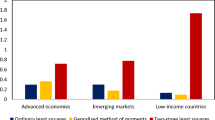

The contribution of this paper to the literature is threefold. First, it contributes to the emerging literature on the impact of institutions and fiscal rules on fiscal policy procyclicality, by constructing an original fiscal rules index. Second, it empirically confronts fiscal rules and institutions (rules versus institutions) and addresses their substituability or complementarity in reducing procyclicality and promoting fiscal discipline. Third, it is related to the literature on exchange rate regimes and macroeconomic stability since its aim is to find whether institutions and rules affect differently fiscal policy procyclicality, depending on the type of exchange rate regime in place. To the best of our knowledge, no paper in the literature has empirically studied under alternative types of exchange rate regimes, how fiscal rules and institutions interact to reduce procyclicality. We estimate a dynamic model with the Generalized Method of Moments (GMM) for a panel of 153 advanced, emerging and developing economies. We estimate the model for two sub-samples of data corresponding to fixed and flexible exchange rate regimes using the Ilzetzki et al. (2019) de facto classification. We also follow Bergman and Hutchison (2015) and construct a fiscal rules index that reflects the overall strength of rules.

We find that under fixed exchange rate regimes, while better institutions help reducing procyclicality, rules can increase it. In particular, in a stronger institutional quality context, rules don’t seem to affect policy procyclicality. This result suggests that under fixed exchange rate regimes, a focus should be put on improving the institutional framework rather than adopting fiscal rules. Under flexible exchange rate regimes, we find that institutions and rules are complementary in reducing procyclicality. Both fiscal rules and institutions are effective in reducing the procyclical stance of fiscal policy. Our results are robust to a battery of robustness tests.

The rest of the paper is structured as follows. “Literature Review” section provides a brief literature review on exchange rate regimes, fiscal policy, fiscal rules and institutions. “Methodology” section presents our methodology and estimation strategy. “Data and Statistical Outline” section describes the data and a statistical outline. “Empirical Results” section presents the results and “Robustness Checks” section discusses the robustness checks. Finally, “Conclusion and Policy Implications” section concludes.

The literature has proposed several solutions to reduce procyclicality bias and more generally to promote fiscal discipline. Debrun et al. (2008), for example, identifies four main categories of solutions: (1) hold policy makers more accountable for their actions (Corbacho and Schwartz 2007; (2) improve procedures for the preparation, approval and implementation of annual budget laws (Von Hagen and Harden 1995; (3) delegate policy or aspects of fiscal policy to institutions that are isolated from short-term political pressures (Wyplosz 2005); and (4) limit the discretion of budgetary authorities through ex ante fiscal rules that provide numerical targets or ceilings for budgetary aggregates or criteria for the conduct of fiscal policy (Krogstrup and Wyplosz 2010).

In addition to fiscal rules, good institutions have recently been proposed as a remedy against fiscal policy procyclicality (Frankel et al. 2013; Bergman and Hutchison 2015). Fiscal rules impose long-lasting constraints on fiscal policy through numerical limits on budgetary aggregates. They aim at correcting distorted incentives and containing pressures to overspend, particularly in good times, so as to ensure fiscal responsibility and debt sustainability. Thus, when properly designed and implemented, budgetary rules can enhance budgetary credibility and fiscal discipline (Alesina and Perotti 1995; Debrun and Kumar 2009). Von Hagen and Harden (1995) and Hallerberg and Von Hagen (1997) use models of political economy to show that fiscal constraints are useful for reducing deficits. Beetsma and Uhlig (1999) show that fiscal rules can improve welfare in the presence of a deficit bias, and that several rules may, however, have the undesirable side effect of reducing productive public spending (Beetsma and Debrun 2004, 2005). Krogstrup and Wyplosz (2010) consider fiscal policy in the context of a common-pool problem combined with international externalities. The authors show that this configuration creates a deficit bias. They also analyze the welfare effects of imposing binding national and supra-national fiscal rules on debt and deficits. They find that supranational budget rules have a positive effect on welfare higher than that of national rules. Moreover, Tapsoba (2012) use impact evaluation methods to assess the treatment effect of fiscal rules on budgetary discipline in 74 developing countries over the period 1990–2007 and suggest that fiscal rules are a credible remedy against budgetary indiscipline in developing countries. More recently, Guerguil et al. (2017) assess the impact of different types of flexible fiscal rules on the procyclicality of fiscal policy with propensity score-matching techniques. The authors find that not all fiscal rules have the same impact: the design matters. Specifically, they find that investment-friendly rules reduce the procyclicality of both overall and investment spending. The effect appears stronger in bad times and when the rule is enacted at the national level. Hence, there is a wide empirical evidence of fiscal rules as a credible remedy for fiscal indiscipline. We consider it is important though to go further in this line and analyse whether there is a more optimal or complete solution for fiscal indiscipline. Indeed, a more focused approach that tries to figure out the underlying politico-economic source of fiscal procyclicality and more generally of fiscal indiscipline could be preferable. We thus focus on the institutional factors leading to excessive deficits and procyclical policy.

Some recent papers have shown the role of institutional quality in reducing deficits and procyclicality. For example, Muscatelli et al. (2012) explain that transparency in the decision-making process helps achieve fiscal solvency. Calderón et al. (2016) examines the role of the administrative quality of government in delivering superior budgetary outcomes. Using a global sample of 115 advanced, emerging and developing countries over the period 1984–2008, they find that institutional quality plays a key role in countries’ capacity to implement countercyclical macroeconomic policies. Their results show that countries with strong (weak) institutions adopt conter- (pro) cyclical macroeconomic policies. Frankel et al. (2013) shows that good institutions fundamentally explain the reduction of policy procyclicality. They find that countries graduate from procyclicality as institutions improve. Moreover, Foremny (2014) shows that the effectiveness of fiscal rules and tax autonomy depends on the constitutional structure of government. The author further explains that fiscal aggregates vary greatly from country to country, even for countries with similar economic conditions, and differences in deficits can be attributed to differences between countries in terms of political and institutional factors. Iara and Wolff (2014) show that the legal base of fiscal rules and their enforcement mechanisms are the most important dimensions of rule-based fiscal governance.

Furthermore, Slimane et al. (2010) show that the ability of MENA countries to conduct countercyclical fiscal policy is affected by the quality of their institutions. Frankel (2011) shows that structural budget institutions succeeded in the case of Chile in implementing countercyclical fiscal policy. Bergman and Hutchison (2015) underline, in a dynamic panel model with 81 developed, emerging and developing countries, that fiscal rules alone are not enough to reduce pro-cyclicality and should be combined with better institutions in order to become more effective. Tapsoba et al. (2017) use panel data from 32 developing countries and find evidence that improvements in countries’ statistical capacity building are associated with less procyclicality of government spending, over the period 1990–2012: the significance of this relationship depends upon the quality of administrative and technical capacity of budgetary institutions. Gootjes and de Haan (2020) examine whether fiscal policy has been counter- or procyclical in a panel of 27 European Union member states over the period 2000–2015. The paper also investigates whether fiscal rules and government efficiency improve the cyclical reaction of fiscal policy. The results suggest that even though fiscal plans in EU countries have an acyclical stance, budgetary outcomes are procyclical and government efficiency and fiscal rules seem to reduce fiscal procyclicality.

Our paper performs in that same vein by examining how fiscal rules and institutions affect fiscal policy procyclicality. More interestingly, we analyse under alternative types of exchange rate regimes whether institutions and fiscal rules are substitutes or complements in reducing fiscal policy procyclicality.

We introduce exchange rate regimes in our analysis because the power of fiscal policy as a stabilization tool might depend on the exchange rate regime, whether it is fixed or flexible. The literature addressing the relationship between the cyclical behaviour of fiscal policy and exchange rate regimes does not provide a clear-cut response. These papers focus on the disciplinary effects of alternative exchange rate regimes on fiscal policy. While certain authors give arguments in favour of the conventional wisdom according to which fixed regimes have disciplinary effects on fiscal policy (Canavan and Tommasi 1997; Beetsma and Bovenberg 1998; Canzoneri et al. 2001; Alberola and Molina 2004; Ghosh et al. 2010; Sow 2015), other support the opposite view that flexible regimes can be associated with more discipline (Fatás and Rose 2001; Tornell and Velasco 1995; Schuknecht 1999; Alberola and Molina 2004). A third strand of the literature argues that neither fixed, nor flexible exchange rate regimes have disciplinary effect on the conduct of fiscal policy (Gavin and Perotti 1997; Kaminsky et al. 2004).

Against this background, the objective of our paper is to empirically investigate the impact of fiscal rules and institutions on fiscal policy procycicality, depending on the exchange rate regime in place. To do this, we test in particular two hypothesis concerning fiscal rules, institutional quality, exchange rate regimes and fiscal policy procyclicality. First, we posit that (H1): under fixed exchange rate regimes, while good institutions help reduce procyclicality, fiscal rules are not effective in curtailing procyclicality. Hence, countries under fixed exchange rates should promote strong institutional frameworks and not focus on adopting fiscal rules. Second, we hypothesize that (H2): under flexible exchange rate regimes, fiscal rules contribute to reduce fiscal policy procyclicality and the effectiveness of fiscal rules is stronger when implemented in an environment with strong institutions. Rules and good institutions are complementary and form a potent combination to reduce procyclicality in this setting.

As aforementioned, our research question is to determine to what extent fiscal rules and institutions affect fiscal policy procyclicality under different types of exchange rate regimes (fixed and flexible). To answer this question, we propose an econometric approach which deals with the cyclicality of fiscal policy and pursues with the impact of rules and institutions on this cyclicality. We estimate the following dynamic specification for each of our two sub-samples: fixed and flexible exchange rate regimes country-groups.

where CGEXP \(_\) is the cyclical component of real government expenditure of country i at time t and CGDP \(_\) is the cyclical component of real GDP (the output gap). They are obtained from the Hodrick-Prescott filter of the logarithm of the series. FRI \(_\) is the fiscal rules index that we construct and BQ \(_\) is our institutional variable, namely the quality of the bureaucracy. \(_\) is a set of control variables that could affect the conduct of fiscal policy according to the literature. \(_i\) measures the country fixed effects and \(_\) is the idiosyncratic error. We include the lagged dependent variable in order to consider the inertia in fiscal policy. Our baseline model with its interactive terms allows us to measure the impact of fiscal rules and institutional quality on the expenditure procyclicality.

The coefficient \(\) measures the impact of fiscal rules on expenditures cyclicality and \(<\lambda >\) , the effect of institutions on cyclicality. This is obtained by derivating the following Eq. 2:

$$\beginA negative coefficient \(\delta\) means that stronger fiscal rules reduce the procyclical stance of fiscal policy. In that case, \(\omega \beta\) everything else kept constant. A negative coefficient \(\lambda\) implies that strong institutional framework reduces the procyclicality of fiscal policy. In that case, \(\omega \beta\) , everything else being constant.

We perform our estimations taking into account the endogeneity issue. In fact, the choice of fiscal rules could not be considered as fully exogenous. One can argue that the objective of fiscal rules adoption is to promote fiscal discipline. Adversely, countries that adopt fiscal rules might have been subject to fiscal indiscipline. This reverse causality causes an endogeneity problem. Estimating the model with the classical OLS estimator would yield biased coefficients since the error term would be correlated with the lagged dependant variable. Using the Within estimator would also yield biased estimations since transformation creates a negative correlation between the error term and the lagged dependent variable, known as the Nickel bias (1981). Thus, we refer to an instrumental variable approach to address the endogeneity concerns.

Furthermore, the effects of rules are perceived after their adoption. In this context, the lagged fiscal rules index appears to be a good instrument to the present value. Hence, an appropriate instrumental variable estimator that could yield unbiased estimations is the Generalized Method of Moments (GMM). We use two lags of the fiscal rules index to instrument this variable. Our measure of the quality of institutions (bureaucracy quality) appears to be an endogenous variable. In fact, one could argue that counter-cyclical (resp. pro-cyclical) fiscal policies that tend to stabilize (resp. destabilize) the economy might improve (resp. worsen) institutional quality. Footnote 1 ) That is to say, the causality may run from cyclicality of fiscal policies to institutional quality and the reverse way around. To address such endogeneity concern, we instrument institutional quality. The literature on institutions has not yet found time-varying instrumental variables for the quality of institutions and relies on cross-country regressions and instruments using European settlers’ mortality and latitude (absolute value), as Acemoglu et al. (2001) and Frankel et al. (2013). Since we are in panel setting, we use as instruments the literacy rate of adults, life expectancy at birth and two lags of the bureaucracy quality variable. Literacy rate of adults and life expectancy at birth undoubtedly reflects the same information as the ones used by Acemoglu et al. (2001), but have a time varying dimension. We perform our regressions using the Arellano and Bond (1991) one-step GMM estimator. The GMM estimator uses internal instruments (the lagged values of endogenous variables) in order to counter the weak instruments problem and the difficulties to treat many endogenous variables at the same time.

However, a statistical issue when implementing the GMM method is the number of instruments which tends to be very high and can weaken the Hansen p-value (the latter becomes less predictive as the number of instruments increases with respect to the number of observations). To tackle this issue, we apply the Roodman (2009) criterion by collapsing the matrix of instruments and/or limiting the number of lags. In addition, we apply the correction of Windmeijer (2005) to get a GMM version that is robust to heteroscedasticity.

Our focus is to analyze how fiscal rules and institutional quality affect fiscal policy procyclicality under different exchange rate regimes. Our investigation covers a total of 153 countries over the period 1993–2015. We classify the countries into two sub-samples (one for fixed exchange rate regimes and another one for flexible exchange rate regimes) using the annual fine classification of Ilzetzki et al. (2019).

To measure the cyclicality of fiscal policy, we use the cyclical component of the logarithm of real government expenditures and the cyclical component of the logarithm of real GDP that are obtained from the Hodrick-Prescott filter (HP filter). Since we use annual data, we follow Ravn and Uhlig (2002) and set the smoothing parameter to 6.25. Footnote 2 Our preference for this variable as fiscal policy variable rather than others like primary balance to GDP ratio, expenditures to GDP ratio, revenue to GDP ratio is motivated by the criticism of Kaminsky et al. (2004). The authors argue that fiscal balance or revenue are the results of fiscal policy rather than its instruments. In fact, if a government wants to influence economic activity, it would modify its expenditure program or change tax rates and such effects would affect revenue and fiscal balance. Moreover, considering the fiscal variable as a proportion of GDP could yield misleading interpretation in the sense that the cyclical behaviour of the fiscal variable may be dominated by the cyclical behaviour of GDP. Furthermore, the advantage of using government expenditures is that co-movements with GDP are able to clearly discriminate between procyclical, acyclical and countercyclical fiscal policy (Bergman and Hutchison 2015).

The source of the data on fiscal rules is ”IMF Fiscal Rules Dataset 2016” from the Fiscal Affairs Department of the International Monetary Fund. We follow Schaechter et al. (2012) and Bergman and Hutchison (2015) and use the large variety of annual information on rules available in this dataset to construct a composite index measuring the overall strength of rules. We start by constructing four sub-indices for the four types of fiscal rules (expenditure rules, revenue rules, budget balance rules and debt rules). Each of the four sub-indices incorporates five main characteristics: monitoring of compliance, formal enforcement procedure, coverage of the rule, legal basis and the escape clauses. Footnote 3 Each sub-index is normalized between 0 and 1. We then sum-up the four sub-indices to obtain a composite fiscal rules index. The composite fiscal rules index is comprised between 0 and 4, with larger numbers indicating stronger rules.

Our institutional quality variable is Bureaucracy quality from International Country Risk Guide (ICRG). ICRG collects a wide range of political, economic and financial information to construct risk ratings. Among these variables, we choose to focus on Bureaucracy quality as it represents ”the institutional strength and quality of the bureaucracy; a shock absorber that tends to minimize revisions of policy when governments change.” It ranges between 0 and 4, with ”high points indicating countries where the bureaucracy has the strength and expertise to govern without drastic changes in policy or interruptions in government services. In these low-risk countries, the bureaucracy tends to be somewhat autonomous from political pressure and to have an established mechanism for recruitment and training.” The life expectancy at birth and the literacy rate of adults variables that we use in the instrumentation of Bureaucracy Quality are gathered from World Development Indicators.

The set of control variables that we employ includes an inflation targeting dummy, the Chinn-Ito index, the degree of government polarization, natural resource rents, the lagged debt level, and the level of development proxied by GDP per capita.

The use of inflation targeting is motivated by the fact that this institutional reform may influence the conduct of fiscal policy by limiting the scope of seignoriage revenues and placing other constraints on expenditure. To address this point, we use a dummy variable equal to 1 if the country has implemented inflation targeting at time t and 0 otherwise. We use inflation targeting as control variable only for estimations of the subsample of flexible exchange rate regime as inflation targeting is a monetary policy framework adopted by countries that are under flexible exchange rate regimes. The data is taken from Aizenman et al. (2011), Samarina and De Haan (2014), Laurens et al. (2015) and Scott and Roger (2009).

We use the Chinn-Ito index to control for international financial openness. The Chinn-Ito index (KAOPEN) is an index measuring a country’s degree of capital account openness. The use of this variable is vindicated by the fact that policy makers may feel more constrained in their actions when their economies are highly integrated with world financial markets.

The literature on government fragmentation suggests that the latter can have harmful effects on public finances (Kontopoulos and Perotti 1999; Volkerink and De Haan 2001). Thus, government polarization may be associated with higher fiscal discipline. We use the Herfindahl index of government composition (the sum of squared seat shares of all parties in the government) from the World Bank Database of Political Institutions to control for government polarization. The higher the index increases, the more polarized the government is.

In addition, the literature on Dutch disease suggests that the abundance of natural resources in a particular country and the mismanagement of resource rents have detrimental effects on public finances (Torvik 2009). Hence, we use natural resource rents (as a percentage of GDP) as a control variable.

We also control for the level of public debt. Controlling for this variable is essential since public debt is an important element of decision when designing public expenditure programs. Jeanneney and Tapsoba (2011) argue that one should control for the lagged public debt as for a given government, the current fiscal policy program is designed under the constraint of previous public debt level.

Finally, we control for the characteristics inherent to the level of development of countries using the GDP per capita. This allows to know whether the behaviour of fiscal policy depends on the level of development.

Table 1 displays the distribution of exchange rate regimes through the observations of our sample. As aforementioned, we use the Ilzetzki et al. (2019) classification of exchange rate regimes. This classification is particular in the sense that it differentiates among episodes of severe macroeconomic stress. It uses movements of dual/parallel market to classify the regime and distinguishes regimes that are ”freely falling” as a separate category. It also uses a five year horizon to gauge the true flexibility of the longer term exchange rate regime. We have a total of 3519 observations—153 countries over the 23-year period- and our sample is almost equally distributed between fixed exchange rate regimes and flexible ones. We classify as flexible regimes all the intermediary and floating regimes (i.e. regimes which are different from the following pegged regimes: No separate legal tender, Pre announced peg or currency board arrangement, Pre announced horizontal band that is narrower than or equal to \(+/-2\%\) , De facto peg). Approximately \(58\%\) of observations corresponds to flexible exchange rate regimes (see Table 1).

Table 1 Distribution of exchange rate regimes in total sampleWe compute basic descriptive statistics on the whole set of variables employed in the model (Table 7 in the “Appendix”). The series of cyclical component of government expenditure and cyclical component of GDP have both a mean value of zero. Their standard deviations are respectively 0.075 and 0.028. The fiscal rules index that we have constructed has a mean value of 0.300 with a standard error of 0.525; its minimum value is 0 and the maximum is 3.425. The bureaucracy quality variable has a mean value of 2.267 and a standard deviation of 1.131.

Table 8 in the “Appendix” reports the degree of correlation between the different variables. There is no strong and significant correlation among variables that can expose the estimations to a colinearity issue.

In this section, we present the estimation results with the validity tests, here AR(1), AR(2), and the Hansen exogeneity test for the instruments. To ensure the validity of our estimates, the following assumptions must be verified: (1) presence of an order 1 autocorrelation: we carry out the AR (1) or m1 test of Arellano-Bond and the p-value of the test must be lower than 0.10 ( \(pp value of the test must be greater than 0.10 ( \(p> 0.10\) ); (3) exogeneity of the instruments: we carry out the Hansen exogeneity test of instruments and the p-value of the test must be greater than 0.10 ( \(p> 0.10\) ) in order to reject potential endogeneity.

Table 2 shows the estimation results of our baseline model for the sub-sample of flexible exchange rate regimes. All the estimations pass the validity tests which are presented at the bottom of the table. We notice an inertia in public expenditure since we get a significant coefficient for the lagged value of the cyclical component of government expenditure in all the estimations. We get evidence of a strong procyclical fiscal policy in the sub-group of flexible exchange rate regime countries. We find a positive and significant correlation between the cyclical component of public expenditure and the cyclical component of GDP. These regressions give strong evidence that rules are associated with a significant reduction of procyclicality (our coefficient \(\delta\) is negative). Institutional quality is also associated with a strong reduction of procyclicality.

Our findings for the sub-sample of flexible exchange rate regimes are in line with those of Wyplosz (2012) and Bergman and Hutchison (2015), suggesting that fiscal rules and good institutions are complementary in reducing procyclicality.

Adding control variables does not change the results. We find that government polarization reduces procyclicality since we get a negative and statistically significant coefficient for the Herfindahl index of government polarization. The more polarized the government is, the less procycliclal the fiscal policy is. One can explain this by the fact that the polarization of government would reduce the chance of conflicts of interest. The ”voracity effects” which are due to the actions of several politicians to appropriate common resources are responsible for fiscal policy procyclicality and this is even more true in periods of export booms (Tornell and Velasco 1992). These effects could disappear as governments are polarized and conflicts of interest are moderated. This result joins the findings of the literature on the fragmentation of government, stipulating that fragmentation has a detrimental effect on public finances (Kontopoulos and Perotti 1999; Volkerink and De Haan 2001).

Table 2 Flexible exchange rate regime: baseline modelTable 3 reports the estimation results for fixed exchange rate regimes. Under fixed exchange rate regimes, we again detect inertia in government expenditures and find strong evidence of procyclicality. After tackling the endogeneity issue, we get strong evidence that the adoption of good institutions should replace the implementation of fiscal rules. Indeed, under fixed regimes, fiscal rules become counterproductive. We find that contrary to the desired effect, rules can have a positive and statistically significant impact on procyclicality. They significantly increase the procyclicality of public spending. This detrimental effect could be explained by the fact that sometimes, rules can have the side effect of reducing productive expenditures (Beetsma and Debrun 2004, 2005).

Table 3 Fixed exchange rate regime countries: baseline modelBasically, under fixed exchange rates, fiscal policy is the powerful stabilization tool for a government in the face of an internal disequilibrium. Monetary policy is fully dedicated to maintain the peg and does not lead to a substantial increase in the liquidity in the economy: the central bank cannot use exchange rates and interest rates as a policy instrument for internal adjustment purposes. Monetary policy has a comparative advantage in adjusting external equilibrium while fiscal policy has a comparative advantage in adjusting internal equilibrium. Under fixed exchange rates, fiscal policy is the main and solely stabilization tool. Adopting numerical limits that constraint the use of fiscal policy can be ineffective. Particularly during bad times, countries get in fiscal deficits as they need to fight against recessions and to restore confidence in the economy. Constraining the only stabilization tool, namely public spending can be ineffective and even counterproductive. Hence, by constraining fiscal policy, the adoption of fiscal rules results in the doubling of the restrictions affecting governments and could yield more discretionary and corrupted behaviour. Indeed, under fixed exchange rates, governments have less room for manoeuvre and stronger rules will further tighten the constraints and would finally become counterproductive. Here too, in our setting, adding the control variables one by one or simultaneously does not affect our findings: under fixed exchange rate regimes, countries should put an emphasis on strengthening the quality of their institutions and not on adopting fiscal rules. We find that government polarization negatively impacts procyclicality since we get a negative and statistically significant coefficient for the Herfindahl index. The more polarized the government is, the less procyclical the fiscal policy will be. We also get a negative impact of the lagged value of public debt on expenditure procyclicality.

In this section, we provide several robustness checks for our empirical findings. We check the validity of our results along three lines. First, we use another variable of institutional quality from a source other than ICRG. Second, we use alternative specifications. Third, we use another method of measuring cyclicality, we use the non-parametric Local Gaussian-Weighted OLS method to compute cyclicality coefficients of fiscal policy.

In order to check the consistency of our empirical results, we use an alternative indicator of institutional quality, namely the government effectiveness index. Concretely, we replace in the baseline regression, considered in the previous section, the bureaucratic quality by the government effectiveness index. This variable comes from the Worldwide Governance Indicators database of the World Bank. Footnote 4 The government effectiveness reflects the ”perceptions of the quality of public service, the quality of civil service and the degree of independence of political pressures, the quality of policy formulation and implementation, and the credibility of the government’s commitment to these services.” It is comprised between \(-\,2.5\) and 2.5 with high values indicating more efficient governments. We rescale it between 0 and 5.

We estimate the baseline model while replacing bureaucracy quality by government effectiveness. Table 4 reports the estimations results accompanied by the validity tests. These results obtained for flexible exchange rate regimes suggest the following: when interacted with the cyclical component of the GDP, fiscal rules don’t seem to significantly limit procyclicality, however government effectiveness significantly reduces it.

We include the control variables and find that countries which are more financially open are more disciplined. Indeed, the coefficient of the Chinn-Ito index measuring the capital account openness is negative and statistically significant. Natural resource rents are associated with more fiscal indiscipline. This result is particularly related to the literature on Dutch disease which stipulates that the abundance of natural resources in a particular country and the mismanagement of resource rents have detrimental effects on public finances.

Table 4 Flexible exchange rate regime countries: robustness checkTable 5 reports robustness checks for the sub-sample of fixed exchange rate regimes. The use of government effectiveness as an institutional variable does not change our conclusion. Here again we get evidence of a substituability between rules and institutions. Whereas stronger fiscal rules result in more procyclical fiscal policy under fixed exchange rate regimes, better institutions contribute to reduce the magnitude of procyclicality.

Table 5 Fixed exchange rate regime countries: robustness checkAs a second robustness check of our results, we consider three alternative specifications. The three alternative specifications that allow us to test the validity of our findings are displayed in the following equations:

We put a focus on fiscal rules (without explicitly considering the institutional quality side), in Eq. 3, and on bureaucratic quality (without taking into account the fiscal rules), in Eq. 4. In Eq. 5 we consider the impact of fiscal rules and institutional quality together and use a triple interaction between fiscal rules, institutional quality and the cyclical component: hence we aim at capturing not only the direct effect of fiscal rules and institutions on the procyclicality of fiscal policy but also their indirect effect through the lens of the cyclical component of real GDP. In all three equations we consider the same control variables. All three models are run for both fixed and flexible exchange rate regimes country-groups.

In the flexible exchange rate regimes country-group, the estimations of Eqs. 3 and 4 underlie that fiscal rules and good institutions diminish the procyclicality of fiscal policy. Hence they can be considered as being complementary in reducing procyclicality. Estimating Eq. 5 suggests that the negative impact of fiscal rules on fiscal policy procyclcicality is more acute when implemented in a context of good institutions. Thus, rules are more effective in reducing procyclicality when institutions are stronger. In other words, good institutions and rules taken together reduce procyclicality: they are complementary. This result under flexible exchange rates regime can be explained by the fact that the economy dispose of both monetary and fiscal policy instruments for stabilization purpose. Fiscal policy is not the only instrument, the economy can rely on the monetary policy and the adoption of numerical rules to limit the procyclical use of fiscal expenditures can effectively work. Moreover, good institutions create a well governed, regulated and supervised framework which constitutes an adequate environment to make rules more effective particularly in a context of flexible exchange rates which is more prone to instability and fluctuations associated with exchange rate movements. The estimation results are presented in the “Appendix” section in Tables 15, 16 and 17.

For the fixed exchange rate regime group, the estimation of Eqs. 3, 4 and 5 suggests that, compared to fiscal rules, institutional quality impact more negatively the cyclicality of fiscal policy. The coefficients of the institutional quality variable in Eq. 4 are stronger than the coefficients of the fiscal rules index in Eq. 3 and the coefficients of the triple interactive term in Eq. 5 is strong and negative. This suggests that institutions are more effective in reducing procyclicality than fiscal rules for the sub-sample of fixed exchange rate regimes. Only strong institutions could effectively help curtailing fiscal policy procyclicality. Tying the hands of governments by adopting stronger fiscal rules in a context where government has less flexibility can be less effective in promoting fiscal discipline. Under fixed exchange rates, strong institutions should substitute the adoption of constraining fiscal rules in order to promote fiscal discipline. We present the estimation results in Tables 18, 19 and 20 of the “Appendix” section.

We provide a third robustness check by using another measure of cyclicality. We follow Aghion et al. (2007) and Guerguil et al. (2017) by computing cyclicality coefficients of fiscal policy using a non-parametric regression method: the Local Gaussian-Weighted Ordinary Least Squares (LGWOLS). This approach allows computing cyclicality coefficients that are country-specific and time-varying. Indeed, it allows capturing the fact that government reaction to business cycle fluctuations may vary over time and differ between the up and down phases of the business cycle.

The estimation of Eq. 6 uses LGWOLS and allows computing the cyclicality coefficients.

$$\beginTo compute coefficients \(<\hat<\beta >>_\) , the LGWOLS weights all observations by a Gaussian centered at t, for country i and then performs one regression for each date t. In fact, the method uses all the observations for each year and the closest observations to the year considered are given a greater weight. Concerning the choice of \(\sigma\) , we follow Aghion et al. (2007) and Guerguil et al. (2017) and use a value of the parameter \(\sigma\) equal to 5.

\(\Delta \hbox (\hbox _)\) is the growth rate of government real expenditure for country i at time t and \(\Delta \hbox (\hbox _)\) refers to the growth rate of government real GDP for country i at time t. The predicted country-specific and time-varying coefficient \(<\hat<\beta >>_\) captures the cyclical behavior of public spending. It measures the cyclicality of public spending for country i at time t. Hence, fiscal policy is considered pro-cyclical (resp. counter-cyclical) if \(<\hat<\beta >>_>0\) (resp. \(

We then use the predicted coefficients \(<\hat<\beta >>_\) (the cyclicality of fiscal policy) as dependent variable and search for the effects of our fiscal rules index and bureaucracy quality index using the following specification:

$$\beginWe estimate Eq. 7 using Two Stage Least Squares estimator to count for potential endogeneity of fiscal rules index and of bureaucracy quality variable. We use the same instruments as in the previous estimations: the lags of the variables of interest, literacy rate of adults and life expectancy at birth. The results of our estimations are presented in the “Appendix” section (Tables 21, 22). Our findings are the same: under fixed exchange rates, rules and institutions are substitutes while under flexible exchange rates, rules and institutions are complements.

This paper investigates the impact of fiscal rules and institutions on fiscal policy procyclicality, under different exchange rate regimes. We show that rules and institutions seem to be substitutes under fixed exchange rates while under flexible ones, they are complements.

For countries under fixed exchange rates, fiscal policy is the powerful stabilization tool for a government. By consequence, adding fiscal rules that constraint the use of fiscal policy might result in doubling the restrictions affecting governments actions (i.e. the monetary policy is fully dedicated to maintain the fixed exchange rates, and the fiscal policy is constrainted by the fiscal rules). Indeed, under fixed exchange rates, governments have less room for manoeuvre and fiscal rules will further tighten the constraints and could finally become counterproductive. A stronger institutional framework could be a sufficient solution to the procyclical stance of fiscal policy when countries are under fixed exchange rates. For these countries a strong institutional environment to govern the conduct of fiscal policy should be recommended to promote fiscal discipline rather than prescribing numerical fiscal rules. This can be achieved for example through the implementation of an independent fiscal agency or a fiscal council (Wyplosz 2005) that can help in the formulation and implementation of sound fiscal policies.

For countries under flexible exchange rates, we notice that the presence of good institutions seems to reinforce the negative impact of fiscal rules on procyclicality, which is in line with Bergman and Hutchison (2015). Rules and institutions form a potent combination to reduce the procyclical stance of fiscal policy: this result holds for countries that are under flexible exchange rates. This latter finding is explained by the fact that under flexible exchange rates, fiscal policy is not the only policy instrument used for economic stabilization purposes, hence adopting measures to constrain distorting policy making can be effective. Since policy makers can rely on monetary policy instruments (exchange rate and interest rate movements) for stabilization purposes, measures to constrain the use of unsustainable fiscal policy can be respected and be effective. For these countries, the adoption of fiscal rules are a good remedy against fiscal indiscipline and moreover, when implemented in a good institutional environment, they are more effective.

Countries under fixed exchange rates can be encouraged focus on improving their institutional framework to overcome the procyclical stance of their fiscal policy through, for example, the adoption of an independent fiscal agency or fiscal council or structural budget institutions instead of focusing on the adoption of numerical rules to govern the conduct of fiscal policy. However for countries under flexible exchange rates, fiscal rules and institutions are complementary in reducing the procyclical stance of fiscal policy. These policy implications of the paper are all the more important in the current context of the Covid-19 crisis which has depicted the importance of fiscal discipline for debt management and macroeconomic stabilization. In the face of the Covid-19 crisis, many countries had to borrow to finance fiscal expansion due to a lack of saved resources from good preceding periods and this situation has undermined the sustainability of debt for countries that were already vulnerable to domestic and external shocks.

Frankel et al. (2013) underline that for example "procyclical fiscal policies could increase the chances of governments running into debt sustainability problems during busts. These critical financing needs could then lead to expropriation, repudiation of contracts, and/or intervention in independent branches of governments such as the judiciary system or the central bank. Moreover, the turmoil typically associated with debt crises can exacerbate corruption in the political system thus weakening the foundations of an efficient and professional public administration”.

For an overview of both HP merits and demerits, see the recent studies of Hamilton (2018), Phillips and Jin (2021) or Phillips and Shi (2021). The HP was criticized due to the choice of the smoothing parameter, to the fact that it might generate spurious dynamics, it might disregard the structural breaks or it might even generate a filtered data with properties that differ across the sample. Despite these critiques, this filter is commonly used throughout the literature [e.g. Talvi and Vegh (2005)]. Recently, Drehmann and Yetman (2018) consider eight measures of gaps (in order to compute credit gaps), using different methods. They show that HP results are robust while some other measures, as the ones suggested by Hamilton (2018), for example, prove to be ill-suited to generating credit gaps. Phillips and Shi (2021) show also through machine learning techniques, that the use of the HP filter is appropriate to be applied in macroeconomics. Alternatives methods to replace the use of HP (e.g. local projections or the Band-Pass filter implemented by Baxter and King) proposed in the literature are also subject to considerable criticism.

All these indicators are 0–1 dummies in the database, except for coverage and legal basis. Coverage can take on three values: 2: general government or wider; 1: central government; 0 if there is no coverage and adjusted upward by 0.5 to account for similar rules applying to different levels. Legal basis can take values between 0 and 5 where: 5: constitutional; 4: international treaty, 3: statutory; 2: coalition agreement; 1: political commitment. In case multiple statutory bases apply, the higher statutory basis is used. These two indices are normalized to be comprised between 0 and 1.

This dataset comprises data on the quality of governance provided by ”a large number of enterprise, citizen and expert survey respondents in industrial and developing countries. These data are gathered from a number of survey institutes, think tanks, non-governmental organizations, international organizations, and private sector firms”.

The views expressed in this paper are those of the authors and do not necessarily reflect the views of the International Monetary Fund (IMF).